8 of Jennifer Lopez’s Most Memorable Met Gala Looks

8 of Jennifer Lopez’s Most Memorable Met Gala Looks

Jennifer Lopez, a powerhouse Latina in Hollywood for nearly three decades, has continuously commanded attention with her music, films, physique, and personal style. While her breakout role in the biographical film "Selena" initially thrust her into the spotlight, it was a bold fashion choice that truly etched her into [...]

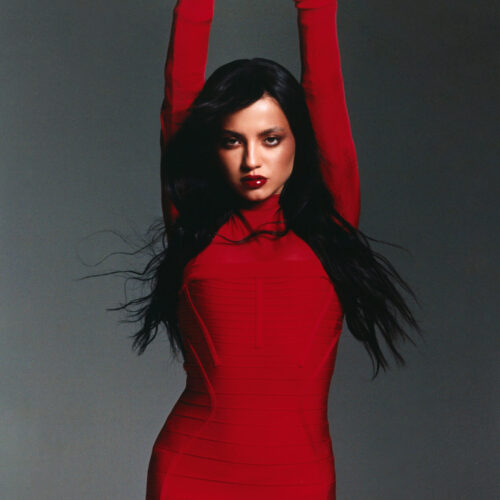

Isabela Merced Is on the Rise

Isabela Merced Is on the Rise

The actress Isabela Merced forged her love of entertainment via the age-old American pastime of visiting the local video rental store. As a kid, Merced’s Fridays were filled with the smell of plastic DVD casings, the feeling of a nubby carpet underfoot, and being exhilarated by the prospect of taking [...]

COVL Becomes First Latina Artist to Collaborate on Ulta Beauty Collection

COVL Becomes First Latina Artist to Collaborate on Ulta Beauty Collection

D'ana Nuñez, known as COVL, has just made history as the first Latina artist to co-create a makeup collection for Ulta’s private label artist series. The limited-edition lineup comprises 10 products, including colorful eyeshadows, lip glosses, funky hair clips, a spa headband set, a candle, and more, all priced under [...]

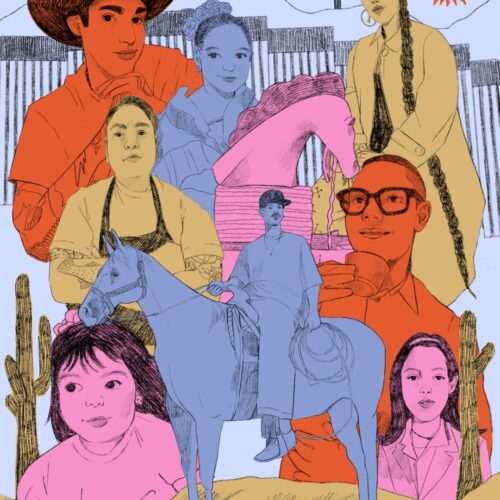

Border Chronicles: Exploring Identity, Art, and Life in the Shadow of Two Nations

Border Chronicles: Exploring Identity, Art, and Life in the Shadow of Two Nations

In early 2021, there were challenges in managing immigration at the U.S.-Mexico border, with an increase in the number of migrants, particularly unaccompanied children, arriving in the U.S. This situation strained resources and led to debates over immigration policy and border security. According to data shared by Border Patrol, [...]

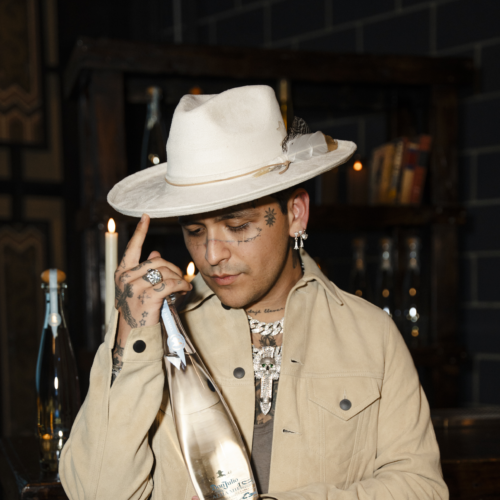

Christian Nodal Talks Album Release, Documentary, and New Collaboration With Don Julio

Christian Nodal Talks Album Release, Documentary, and New Collaboration With Don Julio

Christian Nodal is all about keeping his life as an artist feeling like a dream. From his very first single "Adiós Amor" in 2017 to winning a Grammy, wrapping up a fantastic 31-date arena tour, and sparking a fresh wave of regional Mexican music on the Latin charts, he's been [...]

WATCH: New TV Series “Consuelo” Shines a Light on Sex Positivity and Women Empowerment

WATCH: New TV Series “Consuelo” Shines a Light on Sex Positivity and Women Empowerment

Imagine yourself in the 1950s, freshly divorced and suddenly tasked with selling sex toys. It's a scenario that would make your abuela gasp and your mother blush. Yet for Consuelo, it becomes the catalyst for a journey of self-discovery and empowerment. ViX’s latest TV series, “Consuelo,” [...]

Inside Julio Torres’ ‘Problemista’ and its Boundary-Pushing Take on Immigration and Identity

Inside Julio Torres’ ‘Problemista’ and its Boundary-Pushing Take on Immigration and Identity

There’s no doubt that “Problemista” comes from the brain of Julio Torres. His brand of absurdist humor is instantly recognizable, whether it's his work on “Saturday Night Live,” “Los Espookys,” or his HBO Special, “My Favorite Shapes.” In each, he combines cutting social commentary with unique off-the-wall pairings and brings [...]